Table of Contents

The insurance industry has traditionally been known for excessive paperwork, lengthy processes, and in-person consultations. But that’s changing — and fast. Digital insurance is reshaping how insurance is bought, sold, and managed. It’s more than just moving services online. It’s a full transformation of the insurance model through the use of digital technologies that help to improve customer experience, streamline operations, and create more efficient, scalable solutions.

In this article, we’ll break down what digital insurance really means, what technologies are driving it, and what challenges it faces.

What is digital insurance?

Digital insurance is a term that refers to the use of diverse technologies to enhance and automate the entire insurance process. Basically, it’s the shift of every traditional insurance service to online. This includes everything from the initial purchase of insurance policies to claims processing and customer service.

The main goal of digital insurance is to make the process simpler, faster, and more transparent. It helps insurance companies save time and reduce costs while giving customers more control over their policies.

With digital insurance, you don’t need to make an appointment and visit in person to fill out the documents or get a consultation. For example, if someone wants to buy car insurance, they can go to a company’s website or app, enter their information, and get a quote in minutes. They can choose the coverage they need, pay online, and receive their digital policy instantly. If they have an accident, they can file a claim by uploading photos, filling out a form, and tracking the claim status in real time, and all that without leaving their home.

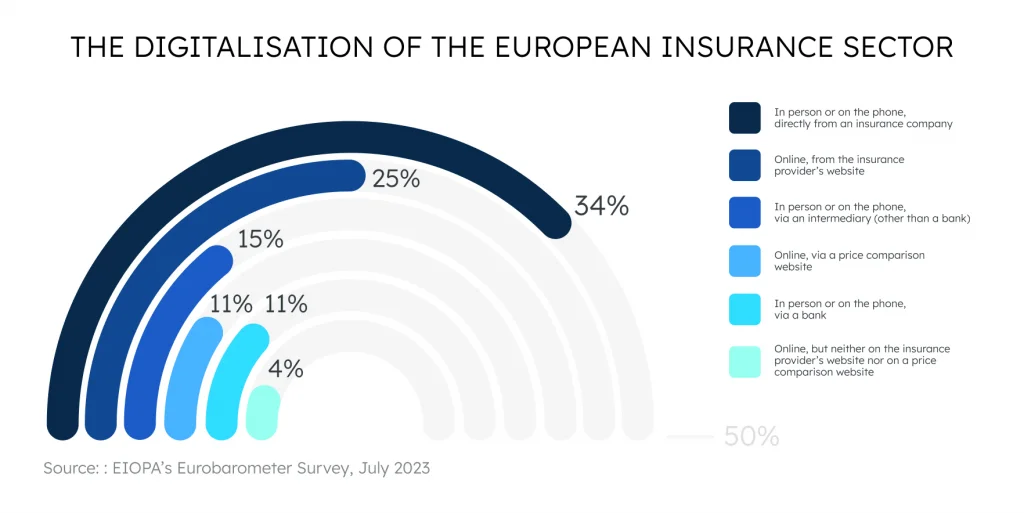

EIOPA’s 2023 Eurobarometer Survey shows that 40% of Europeans are already using digital insurance services. Considering current digitalization trends, this percentage is likely even higer today.

There are several types of digital insurance providers:

- InsurTech startups. These are tech-driven companies that offer insurance entirely through digital platforms. They often focus on specific niches within the insurance market, offering tailored solutions that traditional insurers may overlook.

- Traditional insurers with a digital presence. As simple as that, many traditional insurance companies have embraced digital transformation, enhancing their existing services with online platforms and digital tools. These companies leverage their established brand equity while introducing new technologies to improve customer engagement.

- Platform-based insurance. A lot of companies sell their insurance together with their product or service. For example, Tesla offers its own auto insurance tied to its car’s performance data, or Apple with their AppleCare+ device insurance.

Technologies that shape digital insurance

The rise of digital insurance would not have been possible without advancements in cutting-edge technologies. From AI-driven virtual assistance to fraud detection and blockchain-secured contracts, modern tech helps to make insurance faster and highly personalized. Let’s take a closer look at the technologies driving insurance digital transformation.

Artificial intelligence and machine learning

AI and machine learning algorithms are a crucial part of digital insurance. It helps insurers work faster, smarter, and with fewer mistakes. For example, AI is used to check customer data and quickly decide who is eligible for a policy. It also helps process claims automatically, saving time and reducing the need for manual work.

Many insurance companies now use AI-powered chatbots to answer customer questions 24/7. These bots can handle simple tasks, such as updating contact information or explaining coverage, without human help.

Machine learning is also broadly used for fraud detection. It can find unusual behavior in claims and alert the company, helping to stop false claims before they’re paid. Moreover, with the help of machine learning, the chatbots give better answers by learning from past conversations.

Internet of Things (IoT)

The Internet of Things refers to smart devices that collect and share data over the internet. In digital insurance, IoT is used to help insurers better understand and manage risk. For example, in car insurance, small devices called telematics are installed in vehicles to track how someone drives, measuring things like speed, braking, and distance. Safe drivers can get discounts based on their habits. In home insurance, sensors can detect water leaks, fires, or break-ins, allowing problems to be fixed early before major damage happens.

Health insurance companies use wearable devices like fitness trackers to monitor exercise, heart rate, and sleep. This information can help people stay healthy and sometimes lower their insurance costs. IoT makes insurance more personal and proactive. Instead of waiting for problems to happen, insurers can act early to prevent them. Customers also benefit from better service and more accurate pricing.

Cloud computing

Insurers can leverage cloud services to store and process data without the heavy investment in physical servers. Moreover, cloud solutions enable insurers to launch new products quickly and respond to market changes with agility.

The cloud also facilitates collaboration among various stakeholders, including insurers, brokers, and customers. By using cloud-based platforms, they can seamlessly share data, enhancing communication and streamlining processes. The accessibility of cloud services ensures that employees can work remotely and access information from anywhere, which is an important factor in today’s work environment.

Blockchain technologies

Fraud is one of the major challenges in the insurance industry. Blockchain technology can help mitigate this issue by creating an immutable record of transactions. When claims are made, insurers can verify the legitimacy of the data against the blockchain, significantly reducing fraudulent activities.

Blockchain also enables the use of smart contracts — self-executing contracts with the terms of the agreement directly written into code. In insurance, this means that claims can be processed automatically when predetermined conditions are met. For instance, if a flight is canceled in travel insurance, a smart contract can automatically trigger compensation, streamlining the claims process.

Big Data and analytics

Digital insurance, like any other industry, thrives on Big Data. By analyzing the vast amounts of information that insurance companies receive, they can tailor their policies and improve their offerings.

Big Data also accelerates underwriting, replacing weeks of paperwork with AI-powered instant approvals by cross-referencing credit scores, public records, and even geolocation trends. Fraud detection becomes smarter, too, as machine learning flags suspicious claims by spotting anomalies in photos, repair estimates, or claimant histories.

Advantages of digital insurance

Digital insurance transformation brings a lot of advantages not only for consumers but for insurers as well. Here are some of the key benefits of using digital insurance solutions:

Faster service and response time

One of the most valued benefits of digital insurance is the remarkable improvement in service speed. Traditional insurance processes often involve lengthy paperwork, extensive phone calls, and tedious waiting periods. Digital platforms, however, allow for instant communication and automated workflows.

For instance, claims processing can be expedited through digital channels. Customers can submit claims via mobile apps, attach necessary documents, and receive updates in real-time. This swiftness not only enhances customer satisfaction but also fosters trust between insurers and policyholders, as clients feel valued and prioritized.

More personalized services

Traditional insurance often uses broad categories to set prices and coverage, which means many people end up paying for things they don’t need or being underinsured. Digital insurance changes that by using advanced technology to better understand each customer’s unique situation. With the help of data analytics, AI, and machine learning, insurers can analyze information like driving habits, health data, and previous claims. This allows them to create insurance policies that match individual needs more closely.

Accessible 24\7

Unlike traditional insurance services that typically operate within fixed business hours, InsurTech companies allow users to access their services anytime. Whether through mobile apps, self-service portals, or AI-powered chatbots, you can immediately receive assistance without waiting for office hours or speaking to a representative. It’s not only convenient for customers in different time zones but especially valuable in case of emergencies.

Cost reduction

Digital insurance helps both insurers and customers save money by reducing many of the costs found in traditional insurance processes. In the past, insurance companies had to spend a lot on paperwork, office space, face-to-face meetings, and large customer support teams. With digital tools, much of this work can now be done online, automatically, and with fewer people involved.

Customers can fill out forms, receive quotes, and buy policies directly through websites or apps. Chatbots can handle customer inquiries, providing instant assistance without the need for human intervention. This not only saves time but also allows human agents to focus on more complex customer needs.

Improved risk assessment and fraud detection

As we mentioned, digital insurance leverages data analytics to enhance risk assessment and fraud detection capabilities. By analyzing vast amounts of data, insurers can develop more accurate risk profiles for potential clients. This not only helps in tailoring insurance products to meet specific needs but also ensures that premiums are appropriately priced based on risk levels.

Furthermore, advanced algorithms can identify patterns indicative of fraudulent activity. Insurers can now use predictive analytics to detect unusual claims, significantly reducing fraudulent payouts.

Scalability and flexibility in product offerings

Another notable advantage of digital insurance is its scalability and flexibility in product offerings. As consumer needs evolve, digital insurance platforms can quickly adapt to market demands. Insurers can launch new products or adjust existing ones with relative ease, ensuring that they remain competitive and relevant.

Challenges of insurance digital transformation

The adoption of new technologies and systems rarely comes without challenges. Therefore, alongside the many benefits of digital insurance, it’s important to be aware of some of the difficulties as well.

Data privacy and cybersecurity concerns

As insurance companies increasingly rely on digital platforms, they become more vulnerable to data breaches and cyber-attacks. The sensitive nature of the data they handle, ranging from personal health information to financial records, makes them prime targets for cybercriminals.

The consequences of a data breach can be dire, leading to financial losses, reputational damage, and regulatory fines. Therefore, insurance companies must invest in robust cybersecurity frameworks and establish comprehensive data privacy policies to protect customer information.

Regulatory and compliance hurdles

The insurance sector is heavily regulated, with strict compliance requirements varying by country and region. Digital transformation initiatives often involve changes in data handling, customer onboarding, and even the use of artificial intelligence, each of which must comply with existing regulations.

Customer trust and digital literacy

Some customers still prefer talking to a human, especially for complex products like life or business insurance. Moreover, varying levels of digital literacy can create barriers to engagement. Older generations, in particular, may struggle with new technologies, leading to a disconnect between insurers and their customers. To bridge this gap, companies must prioritize user-friendly digital platforms and invest in educational initiatives that enhance digital literacy among their client base.

Integration with legacy systems

Many insurance companies have long relied on legacy systems that are often outdated and not designed for digital integration. These systems can hinder the adoption of new technologies, making it challenging to implement innovative solutions. Moreover, integrating modern digital tools with legacy systems can be complex and costly.

Conclusion

Digital insurance isn’t just a trend — it’s a transformation. It’s rethinking how insurance works, making it faster, more personalized, and more aligned with today’s digital lifestyles. While challenges remain (especially around trust, regulation, and data privacy), the benefits are too good to ignore.

Comments